Never underestimate the power of a quality factory relationship—or the hardships you could face if you partner with the wrong one.

To help, we’ve identified an effective process with all you need to know about finding and qualifying a quality manufacturer:

- Identify a comprehensive list of promising factory candidates

- Send a request for a quote (RFQ) using our template

- Shortlist a handful of factories using our Factory Scorecard

- Assess your top factories with our detailed criteria

- Use our Due Diligence Checklist to evaluate your factories

- Make your factory selection

This guide will provide you with the detailed instruction you need to assess your factory candidates, start important factory conversations, and help you find the right factory for your custom product.

Keep in mind, though, that this process is a two-way street. Quality manufacturers are generally busy, and can be picky about who they work with. If you’re not a well-prepared and informed buyer armed with the just right questions and ready answers, you risk being rebuffed or ignored by top-line factory candidates. Manufacturers are qualifying buyers as much as buyers are qualifying them.

The best way to go into your factory search, then, is to make sure you’ve done all the work necessary to get to this point.

Preparing for an Overseas Factory Search

To be ready to find a manufacturing partner, you have to have already done a minimum amount of product development and prototyping work on your product. Otherwise, you won’t have the information your would-be suppliers need, and won’t know what to look for in a factory.

To be ready for factory selection, you need to have completed the following actions:

- Conducted deep market research

- Found sufficient market fit for your product

- Proven business viability

- Built a solid product strategy

- Readied your professional design files

- Built a prototype/MVP (minimum viable product) to share as a product sample

- Deduced what you’re looking for in a manufacturing partner

However, if you’ve not completed the above steps, we highly recommend you take a pause here. Review the product development process and understand why it’s so instrumental in establishing your project parameters, projections, estimates, and more. This is all information you’ll need to take with you as you embark on your factory search.

If you have done the above and your product is ready to rock—let’s roll! But before we tell you exactly where to find quality candidates, let’s first get a lay of the land.

Understanding the Supplier Marketplace

Not all manufacturing partners are created equal. There are companies out there that advertise manufacturing capabilities but who will, in reality, outsource the work. These are businesses called “trading companies,” and they differ from original manufacturers both in how they operate and how they’d approach your project if you were to hire one. Know the signs of such trading companies and understand the downsides of working with them before diving into your factory search.

What is a trading company?

A trading company is a business that does not make its own products but acts as a go-between for producers and suppliers. They contract and “trade” with other factories to get wholesale prices and resell goods for a profit, sometimes under a subsidiary brand. They are similar, though not identical, to wholesale distributors in the U.S.

Trading companies best serve smaller projects or instances where you're dealing with a lot of varied product types. They can also be helpful in finding hard-to-source materials. But at the same time, there are many trading companies that simply buy and resell products as nothing more than profit-skimming middlemen.

A challenge of working with trading companies is that they often don’t possess the technical background to properly manage the critical details of a project with the actual factory. When you unknowingly work with a trading company fronting as a factory, you run the risk of major drawbacks:

- A lack of due diligence

- Confused communications

- Quality degradation

- No oversight

- Slow progress and communication

- Inconsistent results

These scenarios can lead to a lengthy and often expensive product development process and a negative experience manufacturing your new product. Instead, we recommend looking for a more traditional factory—an Original Equipment Manufacturer (OEM) to produce your custom design.

What is an OEM?

At Product EVO we prefer working with OEMs, original equipment manufacturers, which make the products (or the parts that go directly into end-products) sold by other companies or manufacturers. These suppliers aren’t typically selling branded products to the consumer marketplace. And that also means they aren’t interested, or equipped, to do much with your intellectual property, or IP.

There are several advantages to working with OEMs:

- Improved production capabilities

- Lower labor costs

- Shorter delays and lead times

- Higher performance and quality

- Increases in product lifespan

- Diversified opportunities for expansion

- Few resale incentives

So if you want a more effective product development process, we believe that OEMs, and not trading companies, are a better choice for most new or custom products.

[At Product EVO, we’ve learned to develop our processes from working in the trenches. You can benefit from our hard-learned lessons and save thousands of dollars in wasted time, money, and inferior products from working with unqualified factories. Click here to get started with us.]

How To Find Production Factory Candidates

The first big hurdle in your search is knowing where to find reputable, qualified factories. And though good ol’ Google can yield some results, it’s more efficient to search online databases for factory listings of suppliers that make similar products to yours.

Here are some valuable resources to help you in your first round of searches. When you’re comparing several factories at one time, score and rank them with our handy Factory Scorecard Template.

Factory Scorecard TemplateTo find listings of factories, look through online resources like:

- Trade organizations

- Importgenius

- Alibaba.com - for factories in Asia

- MFG.com - for factories in Mexico

Also look through sourcing platforms. These are like Alibaba but include business listings and additional access to factories:

You can also try import database platforms, though they often charge for access. These are database services that enable you to look up a competitor’s product and see what the manufacturer of record is on their import documents:

- Panjiva ($150/mo.)

- ImportGenius ($99/mo.)

- AllImport ($20/mo. base)

Don’t forget, you can always cold call companies to ask them where they manufacture their products. You’d be surprised how many will tell you.

Knowing where to find good manufacturing partners is just the tip of the iceberg, however. Learning to spot the trading companies from the factories is another story.

How To Find a High Quality Factory (and Not a Trading Company)

As you shop around for factories, you may find they’re all starting to look and sound alike. So how can you quickly zero in on the qualified players? The first step in choosing the right factory is figuring out if they’re even a factory at all! Here’s how.

Ask for the factory’s website (and not just a listing on Alibaba)

Check for a company website, not just a listing on Alibaba. While it may seem obvious, one of the very first things we request from a new supplier is their company website. Why?

First, they’re not always easy to find on their own. A factory could have multiple websites including page listings on multiple marketplaces that don’t always crosslink. Secondly, a website can tell you a lot without even clicking on it.

When we ask a potential supplier to provide us with their website, more often than not, we get back a link to an Alibaba page.

Here’s an example:

[Exhibit A]

Here’s the trick: See how the URL contains an Alibaba tail? Ex: CompanyName.en/alibaba.com. There are many variations on this pattern; Made-In-China.com and GlobalSources.com are two other common sites as well.

On Alibaba and others, it’s easy to build a profile and “sell” goods. You don't necessarily have to be a manufacturer or represent a factory to conduct business. This makes it tricky for end users to tell the difference. And while scams are rare, it’s all too simple for bad actors to build out a page, throw up some product specs, and be “open for business.”

Many legitimate suppliers are on Alibaba. However, if a potential new supplier doesn’t have their own B2B-facing website and only provides you with a satellite site (passing as their principal website), then this is a clue that the factory you’re looking at isn’t one.

A factory that markets itself with a professional, stand-alone, B2B-facing website can be a quick litmus test for finding actual factories that invest in putting their best foot forward.

If you’re in the middle of vetting factories, check out our free, downloadable Right Fit Factory™ Scorecard to keep track of it all.

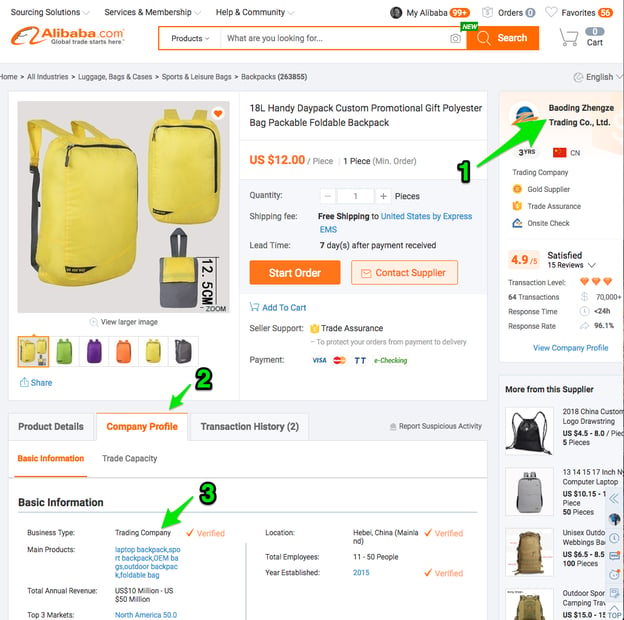

Download the Right Fit Factory™ ScorecardOn its main marketplace page [Exhibit B], this business’ name appears to have a logo with the letters “ZHNET” and a URL that reads “ZZtactical.” However, in smaller letters beside it, and on their Alibaba account (Exhibit A: Arrow #1), you can plainly see the company’s name is “Baoding Zhengze Trading Co., Ltd.” And yes, you guessed it, any business using “Trading Co.” right there in their name, probably is one.

Unknowingly working with a trading company could result in a very lengthy New Product Development process with many new problems to solve.

Josh Taylor, Product EVOEven when a business does have its own branded website—and in all ways appears to be a factory—the company may still operate in whole, or in part, as a trading company. So, you’ll have to do a little more investigating.

Dig into the factory’s business listings

After a quick website check, the next step we take when vetting suppliers for our clients is to look at the factory’s (actual) name and their business listings on marketplace websites like Alibaba, Made-in-China, or Global Sources.com. Here you can verify extra details like company name, their ISO certification (they should have one), business type, and regions they export to.

Look up the factory’s (actual) name and “business type”

Clicking on the company name will take you to a company profile page. Here, you may discover that the company name on the listing isn’t the same as the logo they display, or even the name in their URL extension. This could be a tip off that this is some sort of subsidiary company fronting as a factory, or a sales agent repping for a factory and operating under a different brand.

For example, in the Exhibit B below, though we’d previously seen that this company’s homepage had a URL that says “Zz-castings” [Exhibit A], when we actually click on their business profile page [Exhibit B] it says, “Baoding Zhengze Trading Co., Ltd.” [Arrow 1] on the right hand side of the page. In this case, the evidence is right there in the name.

Even if “trading company” wasn’t in the company’s business name, we can also see that the company’s business type [Arrow 3]—which could list anything from trading company to factory to distributor to wholesaler, etc—also says “verified Trading Company.”

[EXHIBIT B, Arrows 1&2&3]

Examine the company’s product offerings

Beyond the company profile, look for consistency in a factory’s product catalog. Keep an eye out for factories that offer a single product category (or very few), as opposed to offerings across multiple product categories and materials.

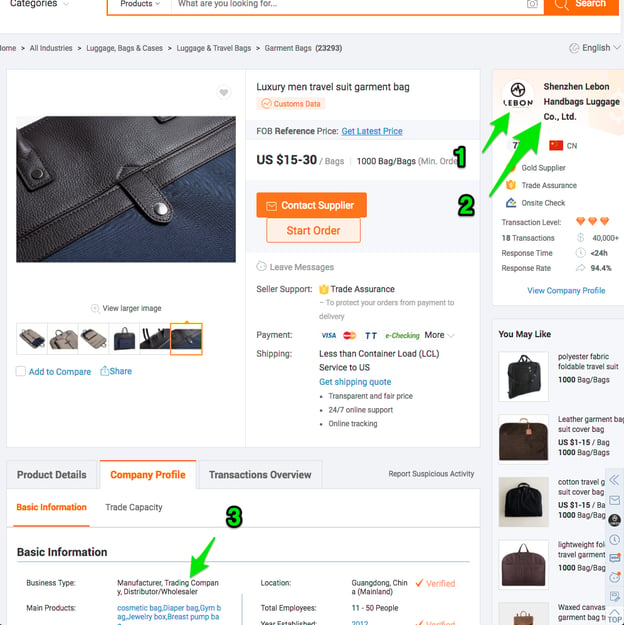

Take a look at Exhibit C below.

[EXHIBIT C]

Ask yourself if this factory passes muster on the following two additional criteria:

- Question #1: Are their listed products directly related to each other?

- Question #2: Are their listed products made from similar materials using similar equipment?

Let’s use our example factory (Exhibit C) to answer those questions:

- Question #1: The company lists many different types of backpacks, briefcases, and tactical bags. So do they pass on the first question? The answer is Yes.

- Question #2: But when you look closer at these products and some of their other products on the right-hand side of the page, you might notice an extensive variety of options: plastic rolling suitcases, leather briefcases, and fabric backpacks of nylon and canvas. So do they pass on the second question? The answer is No.

Although the above Chinese factory [Exhibit C] might still operate as an actual factory producing goods, they probably aren’t manufacturing all of these products in-house. Though this sort of thing can vary by region, in China, it’d be uncommon to find a factory that would manufacture so many different kinds of bags. Raw materials require specialized machinery that’s operated by persons with specific expertise. Machines also take a lot of space to store. For those reasons, factories almost always specialize.

If your factory doesn’t have all of the equipment for vertical production, they have to rely on various other ‘cooperated factories’ to make your product.

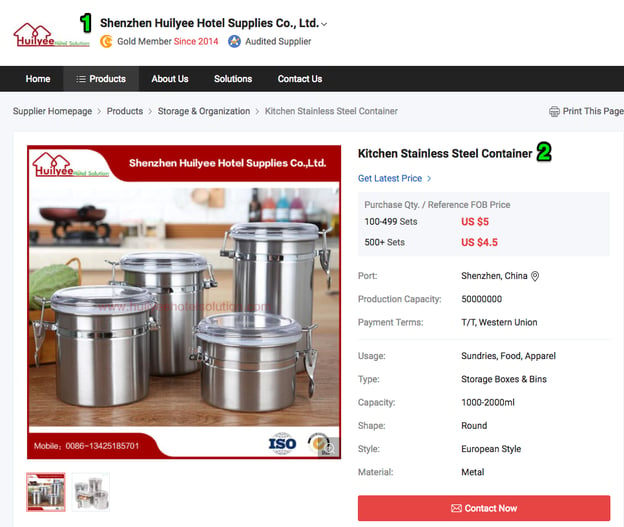

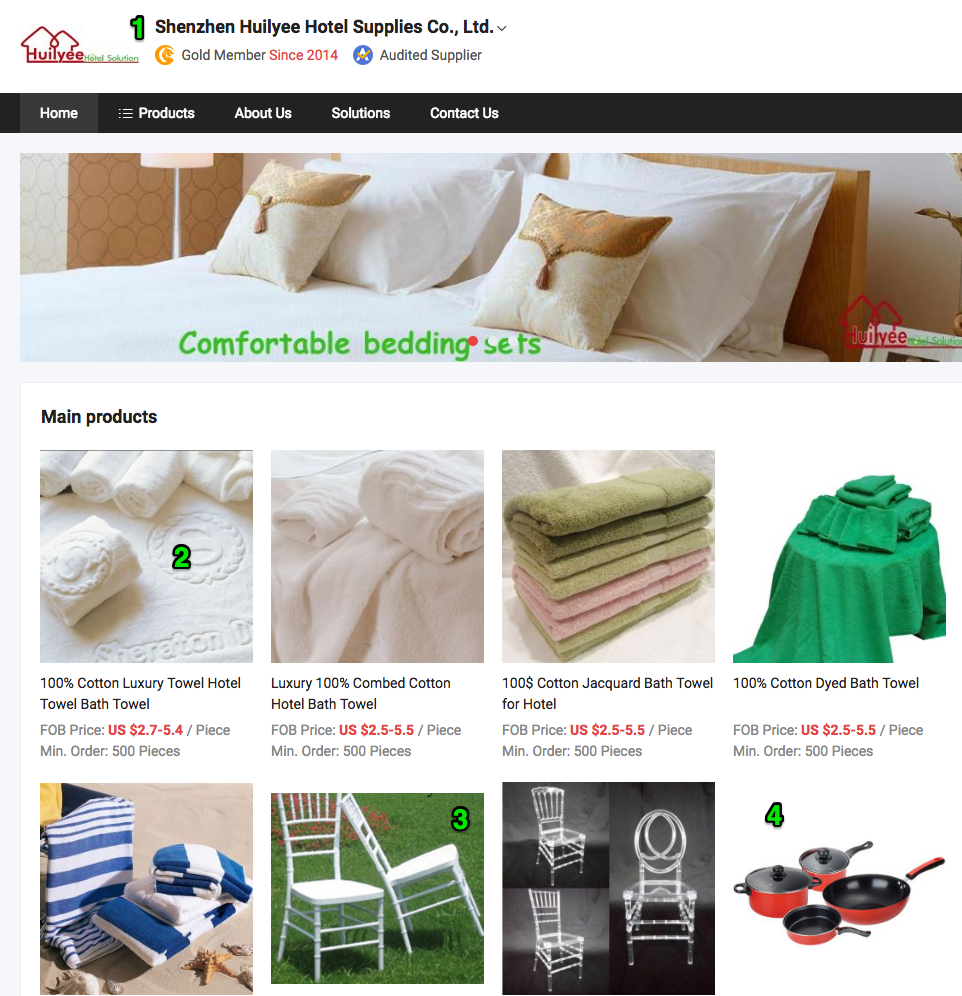

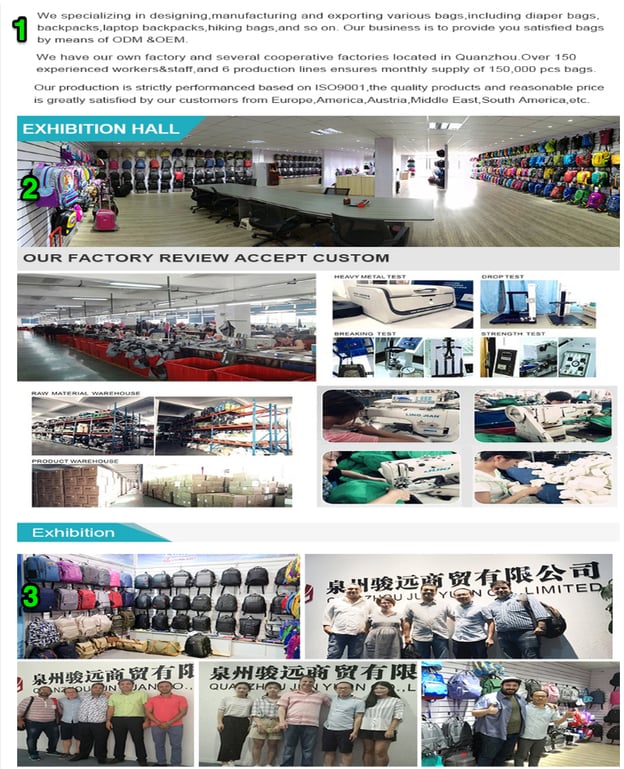

Josh Taylor, Product EVOIn one more example (in Exhibit D below), we see that “Shenzhen Huilye Hotel Suppliers Co. Ltd” has Stainless Steel Kitchen Containers (Arrow 2) on offer. But when we click on the company profile page, we see that they also have supplies of bedding, towels (Arrow 2), chairs (Arrow 3), and cookware (Arrow 4). Because these are all completely different product categories with distinctly different materials and processes, their legitimacy as a standalone factory is highly suspect.

[Exhibit D-1]

[Exhibit D-2]

At this point, we can be confident this is a trading company. This tells us that they have little to no specialization and would be ill-equipped to assist with any technical challenges or oversee QC with a technical eye. In other words, steer clear!

The long and short of it is this: If a factory claims to be able to work with two or three very different processes or materials—it’s time to start asking more questions.

Examine the factory’s export experience

You also want to check a business’ export experience to see if they align with the export quality standards you require. For standards that rival those in the U.S., look for companies and factories with experience in the North American and European market. Avoid companies that serve only a domestic market, or a single region.

Confirm the factory’s equipment

It’s pretty uncommon for small to medium-sized factories to be vertically integrated. An aluminum factory relies on an outside anodizing supplier in much the same way a garment factory depends on a fabric mill to supply the fabric. If the factory you select doesn’t have all of the equipment needed for vertical production, they’ll have to rely on various other “cooperated factories” to help with certain aspects of the process. While some of this can’t be avoided, you can choose to vet only well-equipped factories that can get as much of the work done on premises as possible. That means asking a lot of questions about their equipment, methodology, and entire production process. Finally, don’t neglect to confirm some of these details on your own. Use your powers of observation, and do some investigative work. Look closely at available photographs to better assess the factory and its capabilities.

In Exhibit E (below), the company’s profile lists them as the manufacturer of a wide variety of bags. Based on what we’ve learned about product variance, you might be suspicious. However, the photos posted to their company profile are evidence suggesting that they do have the required machinery to produce such a wide variety of bags.

The products and situations themselves look realistic (#2) & (#3), and so in this case, the factory appears to be forthcoming about what they can produce on-site. Therefore, this particular factory would remain on our list of potential manufacturers.

Shortlist a few good factories

A factory’s experience and capabilities might seem the hardest to evaluate from afar, especially if you’re new to manufacturing and product development but don’t give up! Next up, we’re sharing a little magic trick of our own to help you whittle that list down to just a few qualified contenders.

Request samples

Want to get to the truth about what a factory can deliver? Eliminate a bunch of “wrong pick factories" in one fell swoop:

Ask each factory to send you a sample of a product they’ve manufactured that is similar to yours so that you can get a real understanding of what they can deliver. Next, behold the magic that follows…

Just like that, many “factories” will do you the favor of taking themselves out of the running, either because they can’t be bothered, or because they know that the time it would take for them to get a sample routed from the real factory to you would disqualify them anyway.

Samples are a mandatory part of our factory vetting process at Product EVO. Not only for quality assurance purposes—but for the simple fact that it weeds out a lot of incompetent factories and straight-up trading companies all at once.

Once you’ve removed the factories that didn’t send you samples, the chances are that your shortlist will be significantly shorter than it was before. That’s a good thing! Just like the name “shortlist” suggests, shortening your list is the name of the game at this stage, so be confident and strike those that did not comply.

Send an RFQ

Often referred to as an RFQ, your Request For Quote is a business document that asks factories to respond with pricing and payment terms.

If you want to be taken seriously by good factories and get reasonably accurate responses, you need to come prepared with all of the information in a standard RFQ (below) including theoretical order numbers, and a product prototype whose specs and images you can send.

One big mistake we see all the time is companies shipping off their working prototypes to total strangers overseas, just for the purposes of getting a price quote.

Walk this line carefully. You need to give factories adequate information so that they can generate an accurate quote but not so much information that you compromise your intellectual property.

Here’s a checklist of what to include in your initial RFQ:

- Product Description

- Total Number of Units per Order

- Number of Sizes per Order

- List the sizes or dimensions

- Number of Colors per Order

- List the Colors

- Category / Industry (i.e. sports, outdoor)

- Function

- Usage

- Material

- Unique Product Specifications

To get accurate quotes from factories, download our RFQ Template. It’s the same RFQ template we’ve used internally in our business for years—and it can help you keep track of all those tiny details in one place, too.

Download our RFQ TemplateEvery factory you contact with an RFQ will ask that you send them your product. They’ll say it’s to be able to give you the most accurate quote possible, and they won’t be wrong. You can reassure them you’ll send them your product sample soon enough, but not quite yet.

How to Evaluate and Find the Right Factory

Over the years, we’ve discovered that selecting a good factory has a lot to do with how they rate on these four basic criteria:

- Communication (How well does this factory communicate & how responsive are they?)

- Questions (Are they asking the right questions?)

- Samples (Can they demonstrate their capabilities?)

- Team (Is there sufficient team infrastructure to support your project?)

What do these have in common? They’re qualifiers that make it easy to size up one factory against others.

Communication - Understand your factory well and vice versa

Large-scale industrial production relies on exacting, precise measurements. So when miscommunications happen, they have consequences (and costs) that can be downright devastating. Understanding one another is not just “nice”—it’s critical to the success of the project. So, in whatever capacity you can, vet your factory’s communication skills before working with them long-term.

“If you and the factory can’t clearly communicate, it’s only going to get more difficult as time goes on.”

Josh Taylor, Product EVOAssess your factory contact’s English proficiency

In any other context, placing a value on someone’s ability to converse in English might sound harsh or even intolerant. Very little overseas manufacturing could get done if we didn’t all employ patience and grace with language barriers. That said, if you can’t clearly communicate, it’s only going to get more difficult as time goes on.

Once you have a consistent point-of-contact, such as an account manager, you can assess the ease with which you are able to communicate with them in English. No doubt, this will require at least some investment of your time—at the minimum, a few rounds of emails and calls.

Consider the following:

- When you ask about their company history or specific aspects of your product, do they answer meaningfully?

- How is their written English? Do you struggle to understand them, or is the communication smooth?

- How is their spoken English? Do you struggle to understand them, or is the communication smooth?

- When you do not understand what is being communicated, do they take necessary steps to get the communication realigned? What appears to be their course of action for dealing with communication issues?

One of the best ways to know if your questions are being understood is from the responses you get. If their answers don’t make sense, it’s likely due to one of the following reasons:

- The language barrier

- They’re not experts in the product or category

Either way, it’s a bad sign.

Assess your factory’s responsiveness

English aside, as you compare your communication with different factories, you might notice them falling into one of three categories of responsiveness:

Non-Responsive

These are the suppliers that replied to your RFQ and maybe an email or two but then quickly disappeared.

Responsive

These are suppliers that got back to your emails and questions promptly. They answered most or all of your inquiries and replied with thoughtful follow-up questions. When you took a day or two to respond, they didn’t hound you for answers. There was some give and take in the conversation.

Too-Responsive

These are the suppliers that email sometimes 2–3 times per day, sending you their factory information, requesting samples, and vying for your business. None of their emails have much to do with your actual project. Although they email you repeatedly, they never seem to answer your direct questions.

The factories that fall under #2 “Responsive” are in the sweet spot. A responsive, attentive supplier that doesn’t go overboard with solicitation is, in our opinion, a great sign that you and this factory could be a good match.

[Looking for some product love and can’t find a suitable mate? We can help.]

Once you’ve done the above, you should have a shortlist of potential factory candidates containing only those you can communicate with clearly and who look like they would be a good fit for manufacturing your product.

Questions - Assess the quality of your factory’s questions

In much the same way that asking the right questions tells you which factories know their stuff and which do not, the quality of the questions your factory asks you tells you a lot, too.

Consider the following:

- Are their questions too general for being purported experts of that type of manufacturing or process?

- When you leave out information, do they notice, and ask you to provide that information?

- Do they ask relevant and thoughtful questions that show their understanding of your product?

- Do they ask few to no questions at all?

When it comes to conducting business overseas, it’s imperative both parties understand one another with crystal clarity. Remember, if you find it’s a bumpy ride with a factory from the start, assume it’s only going to get worse.

Samples - Assess the quality of your factory’s product sample

You asked every factory on your shortlist to send you a sample of a product they have manufactured that is similar to yours. If you’ve followed our advice, step by step, those factories who did not send samples have been removed from your list. Now, with a shortened list and hopefully a number of samples in your possession it’s time to do two things. First, assess the quality of the product itself. Second, deduce whether or not the factory has the capabilities of making your product.

Assess sample product quality

Assessing the quality of the product samples you receive will be hard work if you’re unclear on what to expect.

Assess your factory’s capabilities

With a physical product in hand, you can assess the quality of the product itself as well as deduce whether or not the factory has the capabilities to make your product.

So what exactly are those expectations? Consider…

- Performance and intended function.

- Reliability of the product within a specific time frame.

- Conformity to product specifications.

- Product durability and lifespan.

- Product serviceability.

- Physical features of the product.

Having a physical product in hand enables you to carefully assess the product’s quality and discern whether or not the factory in question is capable of making your product in a way that meets your standards.

Team - Get to know the factory’s support team and staff

One way to know that you're dealing with a well-equipped factory (and not some one-man-in-a-garage operation) is by getting to know their team.

Try to build relationships with more than one member of the factory’s staff, ideally across different departments (sales, engineering, production, leadership).

The best kind of contact will be an English speaker with some sort of technical experience, as they can help bridge the experience gap from the sales or management office to the factory floor. Try to ask all sorts of technical questions, to see how they answer them. Best case scenario: your contact is able to answer confidently, but still confers with the other experts on their team.

All of the above are excellent signs that your supplier has the basic infrastructure needed to support your product during its development.

Visit the factory or request a virtual factory tour

While physically traveling to a factory won’t be possible for everyone, it’s one of the best ways to test relationships, vet a factory’s equipment and capabilities, and do an overall gut check. If you can’t travel overseas, make sure to request a video tour. Any factory you do business with should welcome clients to see and visit their facility, whether in person or virtually.

For starters, it’s an opportunity to get a sense of a factory’s scale and production capacity. Hire a factory that’s too big, and you’ll likely end up as a low priority and won’t get the personalized attention you require. But if the factory is very small or understaffed, the chances of them floundering (on expertise, equipment, capacity, etc.) or contracting out to other suppliers is pretty high.

In person, you can even get a sense of the factory’s culture and working conditions through the simple exercise of smiling, engaging, and observing the factory employees. Do you get smiles back? Do employees appear at ease engaging with you or do they barely look up? Both scenarios tell a different story—and are easily understood without language.

For better or for worse, visiting a factory offers those intangibles that are hard to judge any other way. Years ago, during one of Product EVO’s factory site visits we saw that a particular factory had employees living just outside their fence in bare shipping containers. It was a powerful image that stuck with us, and caused us to eliminate that particular factory from our list.

On the tour, look at both the factory conditions, and how comfortably your point-of-contact answers questions on the fly.

We would be terrified to do business with a factory that we haven't stepped foot in at least once.

Josh Taylor, Product EVOHow much these elements factor into your final factory selection is, of course, entirely up to you. But at Product EVO, we factor them in quite a bit. We’ve ruled out entire relationships based on what we’ve learned during site visits. At the same time, we’ve discovered some really great, smaller factories by visiting in person too. [Let us know if we can connect you with one of them by booking a strategy call].

Make your factory selection

Once you’ve deemed the quality coming out of each of your factory candidates is up to your standards—and they meet all the other criteria laid out in this document—you’ll probably notice that your remaining factories have naturally clustered around the same basic price points. Now what?

Negotiations around a product’s manufacturing price are complicated, arguably an art form, and one we’ll explore in a future guide. But all things being equal—quality in particular—then it goes without saying that this is the point when the price comes back into play.

However, finding a supplier that can deliver on your timelines, hit your quality requirements, meet your target price, and be an ongoing partner in your success is about so much more than price.

In other words, you’re ready to (finally) make your factory selection! No room for “analysis paralysis” now. Who’s your all-star?

No matter what, by this point we hope you feel confident that you’re making a thoroughly vetted, well-informed choice for your overseas manufacturing partner.

Ways To Avoid Issues When Outsourcing Manufacturing Overseas

While sourcing isn’t rocket science, it can be a lot of meticulous, time-intensive work. So here’s our tried-and-true advice on how you can avoid issues when outsourcing manufacturing overseas.

Level up your communications

Communicating with someone on the other side of the world takes reserves of patience and practice. Set your factories up for success by using communication strategies that bust through the language barrier, and get your message across correctly the first time. Here’s how:

Use visuals whenever possible

The cliché that a picture is worth a thousand words is no truer anywhere than in working with a factory. And if a picture is worth a thousand words, then a video is worth ten thousand.

Years ago, we spent weeks on a backpack project, trying to get the factory to understand what we were asking for. We were at a stalemate until we built a simple backpack frame from wire, poster board, and tape. We sent the engineer a video showing how our homemade on-the-fly backpack frame worked, and our production problem was solved within 24 hours.

At Product EVO, we don’t explain anything to our suppliers without pictures, screenshots, diagrams, or videos. Visuals cut through language and cultural barriers much faster than other forms of communication. It might take a little longer than shooting off a couple of lines of text in an email, but clarity is always worth the extra effort in product manufacturing.

If your requirements are subjective in any way, they will be misunderstood and your product will come out wrong—each and every time.

Josh Taylor, Product EVOBe objective (not subjective)

This one sounds easy but it’s not. When you tell your supplier that you want something bigger, printed darker, or to feel a little softer—only you know exactly what you mean by this.

If your requirements are subjective in any sense, they can be misunderstood, and your product will come out wrong—every time. Do the extra work to define them objectively. Get out a tape measure, calipers, calculator, Pantone book, durometer—whatever it takes to deliver an objective description to your manufacturer.

Capture all decisions in one place to prevent mistakes

Leaving design details up to interpretation can be costly. You can send over good tech packs or CAD files at the start of a project, but at some point product information, updates, and new decisions get spread out all over email, WeChat, calls, meetings, and various sample revisions. As a result, decisions get lost, and (guaranteed!) mistakes will get made down the line.

Do yourself a favor and document every specification and decision about a product in one single place. Diligently work to keep it updated. Every time something new is established pertaining to your product, update the documentation accordingly. Know that 99% of the time, not doing so will result in mistakes and wasted time.

Conduct a final process audit

There’s one final way you can assess every detail of a factory’s production capability. It’s by doing a full process audit. What it does is lay out exactly how the factory intends to build your product from start to finish. It’s a detailed explanation of the steps involved, the machines, and the processes that go into your specific product so you can be sure the manufacturer adheres to your list of expectations.

It’s also another way to uncover what a supplier does and does not do in their own factory, and which parts of the process they’ll outsource to other suppliers if any. It’s also a good time to review standards and processes, like REACH Standards, California Prop 65 Standards, and UL for electrical products. Much more is said about process audits in our Complete Guide to New Product Development.

Now that you’ve selected your factory, you’re probably negotiating with them or working on your Golden Sample (the final prototype the factory will use for building your first production run). Unless you’re stuck. If you are, you may want to consider a U.S.-based manufacturing partner who’s equipped to aid and train you in managing this process.

Making the Case for a U.S.-Based Manufacturing Partner

There’s a strong case to be made for using a U.S.-based manufacturing partner who can help you test and finalize your product design, protect your IP, and source a reliable factory partner capable of delivering your product exactly to spec.

A U.S.-based manufacturing and development partner can help you with:

- Factory Sourcing & Selection

- Product Discovery, Strategy & Business Analysis

- Product Profitability Outlook

- Manufacturing Operations Management

- Establishing Processes & Standards

- Product Development & Prototyping

- Supply Chain Management

- Quality Control & Inspections

- Factory Troubleshooting

- And more!

With a U.S.-based product development team like Product EVO, you can start with just a product idea. We can help you do all the necessary groundwork to correctly ideate, strategize, iterate, test, and develop a product that both meets market need and connects to real customers. All the while, we’ll be making sure your manufacturer is well-equipped, qualified, and ideal for making your new product.

Operate with a trusted partner who understands both your product and your vision. The experts at Product EVO know how to navigate the entire product development process all the way from idea to store shelves.

Quality Control

One of the hardest and most frustrating manufacturing steps to get right is Quality Control, aka “QC.” A manufacturing partner here in the U.S. can help you determine and deliver all the detailed requirements a factory needs to set up an effective quality control system. A U.S.-based manufacturing partner can assist you with:

- Assembling a Bill of Materials (BOM) that details all the materials, components, parts, and sub-assemblies needed to create your product.

- Understanding Functional Testing Requirements as part of your QC Checklist.

- Explaining Your Product’s Critical Function because it’s easy to assume that your factory knows what your product should do (but that’s not always the case).

- Understanding Acceptable Quality Levels (AQL) which are defined as the least tolerable level for acceptance (either critical, major, or minor).

By helping you establish a QC process from start to finish, a U.S.-based manufacturing partner will assist in handling these technicalities and ensure you don’t neglect anything critical along the way.

Logistics

Overseas logistics can be a nightmare. We are often called upon to step in to help with this particular aspect of overseas manufacturing: Logistics (everything that goes into the packaging and shipping of a product from the factory floor to your warehouse and, if necessary, on to the consumer).

One year a disc golf client of ours had tested their shipping cartons repeatedly to ensure that their pallets of product would arrive to the U.S. in mint condition—but hadn’t put the same care into testing their direct-to-consumer packaging. This resulted in many broken and bent discs arriving to unhappy customers. We were able to identify the problem and resolve it with a quick change to their supplier, and by streamlining some of their shipping operations.

This is just an example of how something seemingly simple and straightforward can get overlooked, when factors like cost, deadlines, and resources come into play. We can help with the following:

- Providing packaging best practices that clearly specify materials, dimensions, thickness, and colors.

- Choosing correct shipping cartons that don’t inadvertently crush the internal packaging during shipping. Using a suitable shipping carton for your product is especially important for Air Freight and LCL shipments.

- Packaging, shipping, and drop-ship testing. Gain insight and learn what works for your product. We’ve seen too many products get destroyed during transit—don’t let your first batch be one of them!

Coordination

Now that you have all of your specifications in one place, you’ll want to use them to create clear expectations around what will be accepted and rejected after production so that there will be no surprises. As we’ve covered extensively in this guide, communication can be a make-or-break component of your manufacturing experience, so you may choose to have experts handle that for you. A U.S.-based manufacturing partner can help you in your product development process by:

- Establishing clear communication channels

- Hiring 3rd-party suppliers

- Setting QC Standards for 3rd-party testing

- Overseeing timelines & requirements for lab testing

- Catching the stuff that usually gets missed

Once you’ve thoroughly researched, selected, and qualified your factory, you’ll be preparing for your first production run. You’ll need to have your QC, AQL, and logistical standards ready.

To learn more about every step of the product development process, make sure to check out our blog and follow our social media channels as a resource.

Final thoughts on finding your Right Fit Factory™

We know how finding a great manufacturing partner can feel like searching for a diamond in the rough. We hope this guide has helped you develop an ability for finding those diamond-caliber factories and enriched your understanding of all that goes into finding the Right Fit Factory™ for you. A trustworthy, detail-oriented overseas manufacturing partner is an incredibly valuable asset, one you’ll appreciate all the more when you find the right one.