How to Conduct Market Research

Stop me if any of this sounds familiar.

Market demand wasn’t where you expected for your last product. You’re worried about whether or not the ROI will be there for all of the work you’re putting into your product. You’re tired of losing to your competitor’s products. You’re sick of the setbacks caused by products that don’t sell as well as you hoped. There’s no shortage of ideas but you’re not sure which will be worth the time and whether you should follow your gut or the data to decide.

Sound familiar?

Luckily, there is hope.

You can conduct market research to increase your odds of success and ensure you don’t waste precious time and resources building a product no one wants and solving a problem no one has.

We’ll show you how we conduct market research for our clients so they can launch profitable products and services that drive growth in their business, faster than if they just jumped right in.

What is Physical Product Market Research?

Market research is the process of gathering information about your customers and the market as a whole to assess a product’s viability and shape product strategy. The goal of market research is to better understand your customers, their problems, pain points, and desired solutions as well as understanding the broader market (e.g. assessing the potential number of buyers or evaluating your competitors’ offers). By utilizing market research methods such as qualitative and quantitative research methods including (but not limited to): surveys, customer interviews, competitor reviews, data analysis, etc, we’re able to validate important aspects of introducing a new product to the market that should not be left to chance. This helps with validating things like features that people would be willing to pay more for instead of making assumptions like most companies do, which inadvertently leads to overpricing their products to the point where they sit on shelves and never gain traction. These are the types of mistakes that can be avoided by simply taking the time to do market research BEFORE going into production for your product.

Why Market Research Matters

This probably won’t come as a surprise but launching a new product or service is hard. We’ve spent decades launching new products, studying processes that increase the odds of success, and supporting our clients in launching new products profitably. Through a better understanding of your potential customers and market, you can design a product that more directly solves their problems, increasing your chances of success.

There are three major challenges we see.

Three Common Challenges with Launching New Physical Products

- Most new physical products fail. In a report from MIT, Clayton Christensen, a former professor at Harvard Business School, estimated that as many as 95% of new products fail. Their number one reason for this? No market research. And they’re not alone. CB Insights reports that 54 percent of all product failures happen because there was either no market need, or there was a flawed business model to solve those needs.

- It’s expensive. Launching a new product is expensive. For physical products, there’s product design and development, purchasing inventory, marketing, and of course, sweat equity, amongst other things. It’s not uncommon for us to see founders investing hundreds of thousands of dollars to launch a new product. The process requires significant investment and there’s massive risk. A lot has to go right in order for a new product to be launched, let alone be successful. Blindly creating something based on passion and a great idea rarely leads to the outcome that most companies hope for.

- Market research is time-consuming (and expensive). One of my favorite quotes is from Tony Faddell, lead engineer of the iPod and iPhone, and creator of the Nest Thermostat. He says, “the more amazing an idea seems, the more it tugs at your gut and blinds you to everything else, the longer you should wait, prototype it, and gather as much information as possible before committing.” If this idea is going to eat up years of your life, you should at least take a few months to research it and build detailed product development plans. You do not want to start a company only to discover that your seemingly great idea is a shiny veneer over a hollow tooth, ready to crack at the slightest pressure.

Now that we’ve discussed common challenges with launching new products and roadblocks to conducting market research, let’s discuss our step-by-step process for conducting effective market research.

Conducting Market Research for New Physical Products

The market research process we’re going to share with you is specifically designed for small to medium businesses with motivated founders. At Product EVO, we’ve spent decades studying this topic, taking courses, and more importantly, putting those ideas into practice for our clients and refining them down to the 20 percent of things that get you 80 percent of results.

For example, we recently helped Dynamic Discs test market demand and find a production partner for their new Scout Baskets, generating $2.4M in new product revenue in the first half of the year. They are now the exclusive disc golf supplier to Walmart.

We’ve developed a lean and mean new product market research process that is very practical and easy to implement and will help you avoid the challenges we discussed above. This is one small part of our unique approach that helps our clients improve their chances of success and get to the end goal of driving growth with a profitable new product or business faster (and with higher chances of success) than if you ignored and rushed into making things without doing the proper diligence.

Before we give you our step-by-step process for conducting market research, let’s discuss two key mindsets for market research that will improve your odds of success when developing your new product.

Mindset Shift 1: No Sacred Cows

Stay open to new ideas and new ways to achieve your company goals, even if it means killing your darlings. Most people start the market research process with a specific product or business in mind.

Too many people fall in love with their idea and it makes them blind. They ignore the data they uncover through their market research and stay stuck on their original ideas, effectively rendering anything they discover in the process moot. That's why we believe that there are no sacred cows. Follow the data. Be a skeptical optimist. Look for new ways that new products can create value, but don't give it a free pass. You have to be skeptical in order to vet things well.

Be open to new ideas and new ways to achieve your company and customer goals. The lasting value will always be greater than chasing the next big thing. You are risking your time and money on these ideas; don't get caught up in passing fads or industries that don't have real business value.

Mindset Shift 2: Build Something One Hundred People Love

Brian Chesky, founder of AirBnb, said, “Build something that 100 people love, not something that 1 million people kind of like.” According to Chesky, that was the best advice he ever received on building successful products that reach mass adoption. That advice came from Paul Graham, investor and co-founder of YCombinator, a startup accelerator that has helped launch companies such as Airbnb, Stripe, Coinbase, Instacart, and Gusto, just to name a few.

That is one of our secrets for succeeding in today’s overcrowded marketplace: build something that one hundred people love. If you build something 100 people love, you may get to a million but if you build something 1 million people kind of like, you may not get to 100 customers. Why? Because people pay for things they love and they become evangelists for the things they love but almost never for the things they like.

How do we build something people love? By understanding their needs and creating products that solve their problems.

Your goal with market research is to uncover customer needs so you can effectively design for product market fit and build a product people love and that solves their most pressing problems.

Now that we’ve discussed two important mindsets for conducting market research for physical products, let’s move on to an overview of our step-by-step process.

A Step-by-Step Guide on How to Do Market Research for New Physical Products

Remember, this process is for companies that are lean and mean. We’ve outlined our comprehensive process for conducting market research for new physical products. The steps in this process are:

- Uncover Customer Needs to Design for Product Market Fit

- Estimate Your Total Addressable Market Size

- Estimate Your Realistically Attainable Market

- Stop Vetting and Move on to Development

Let’s dive in.

Step 1: Uncover Customer Needs to Design for Product Market Fit

We're in the greatest period of innovation and growth that we'll experience in our lifetimes...because crisis interrupts patterns. We've just had multiple crises over the last three years like the global pandemic and multiple wars. This led to supply chain issues and increased costs on things like shipping containers and raw materials. Just as we've adapted to changing circumstances, our customer needs have adapted.

The keys to success will be identifying how those needs have shifted and figuring out how to leverage your unique advantages to serve them better than anybody else.

Your first goal is to deeply understand your target customer. You want to learn what problems they face, what goals or outcomes they desire, and what solutions currently exist (if any).

“The demand for the thing the product does exists before the product.” – @vvtraining

When it comes to market research, we're not trying to predict the future. Our focus is on provable demand and finding the opportunities that exist right now. We do that by answering a few questions:

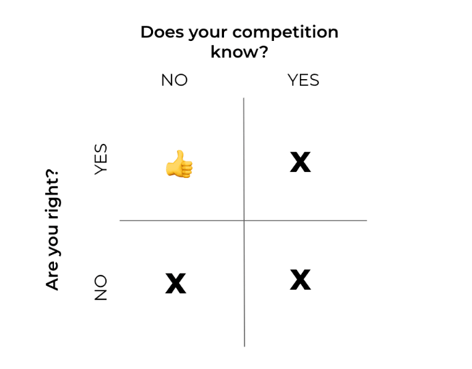

- Does the market have a need for your product? If so, is your competition aware of that need, and are they doing anything to serve that need?

- Are you right? Up to this point, you may have implied that customers need your product idea, but by answering yes to this question, you will have evidence that this is the case.

The sweet spot in all of this exists when:

The sweet spot in all of this exists when:

- There’s a need that your competition isn’t serving.

- You have clear evidence that there is a need for your product idea.

- We’ve found evidence that our hunches are right in the areas that our competition is not aware of yet.

- Therefore we are not creating new demand. (Creating new demand that’s for large businesses with massive budgets.)

Our goal is to figure out where the real passion and need already exists. To find that, we need to know where to look.

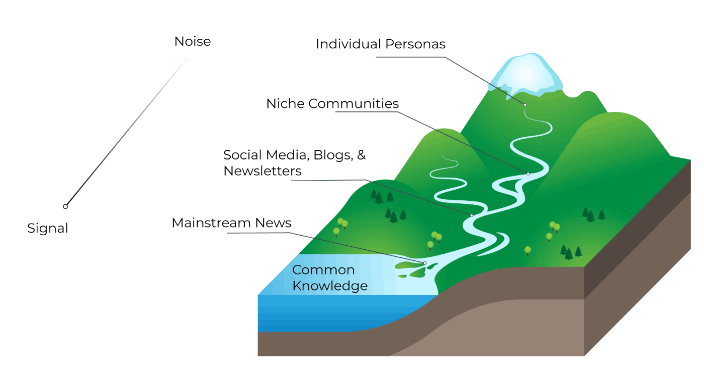

Since we're looking for existing demand and not predicting the future, we need to go “uphill” where ideas get started.

If you know where to look, you're going to come across ideas long before most. It’s going to seem like you're predicting the future, but you're not. To do that, we need to separate the signal from the noise.

If you know where to look, you're going to come across ideas long before most. It’s going to seem like you're predicting the future, but you're not. To do that, we need to separate the signal from the noise.

“Signal is the meaningful information you’re actually trying to detect. The noise is the random, unwanted variation or fluctuation that interferes with the signal.” – Conceptually

At the bottom of the hill is where the signal is the strongest. This is “the pool of common knowledge.” These are the things the mass media reports on. By the time major media outlets are reporting on something, it's common knowledge. This is a red ocean, there will be far too much competition. Competing in a red ocean is very expensive and it’s a good way to burn through capital and fizzle out into nothing.

On the other hand, you've got your noise. These are individual personas or people. While they may be able to articulate their problems or needs well, the number is too small. We don't know if there's a critical mass of people to serve.

We focus our research on niche communities and social media, blogs, and newsletters, in that order. We use qualitative research to understand the needs of the customers and we start to see larger pools of demand. Qualitative research is great for consumer, B2B, and software products.

Utilizing focused qualitative research can help you find niche communities so you can move away from the deep pool of consumer knowledge into shallower waters. We’ve included our favorite places to find niche communities along with tips for researching each of them.

-

Google

- Use Google’s built-in tools to see what related terms of keywords are. As you start to type in your search, Google populates related searches. Capture those either in a screenshot or by writing them down to use to follow other threads.

- When you search in Google, use terms like "top challenges/fears with [your subject],” “top goals with [subject],” or "why is [subject] so hard.” This will yield helpful results on the top pain points and goals people have in a certain area. You will start to see what needs are being met and what ones aren’t.

- Pay attention to any industry trend articles you come across. While searching for a particular subject, you may see a related or adjacent trend arising. For example, you may search “problems with kitchen organization” and find an article about how “fridgescaping,” organizing your fridge so it's aesthetically pleasing, is trending on TikTok. This helps you understand current trends so you can potentially capitalize on them.

- Use custom search parameters to dig deeper into your competitors. For example, you can use “site: competitor.com “topic” filetype: pdf” to search a specific competitor’s site to search the resources they have on a specific topic. You can also leave the competitor’s website off and just search for file type which should give you great data.

-

Facebook Groups

- According to Pew Research, 7 in 10 Americans say they still use Facebook as of early 2024. Facebook is great for niche-specific enthusiast groups.

- Search for groups related to your topic. Once you’re in a related group, use Facebook’s native search tools to search within a group to find topics related to the problems you’re trying to solve.

-

Buzzsumo

- Buzzsumo is a phenomenal tool with free and paid versions. You can do topic research and search for trending topics. We use the “Discover Questions” tool in Buzzsumo to dig deeper into topics we discover in other searches. This tool yields questions that people are asking and answering and helps prove demand for a product opportunity.

-

Amazon Reviews

- Reviews are like micro-communities commenting on a product. They are having focused conversations on that specific product which are treasure trove of useful data.

- If you are a service or b2b company, look for reviews on books on your topic. For example, if you have a cleaning company, look up books that teach you about cleaning or how to run a cleaning business. You’ll see the conversations people are having there.

-

Reddit

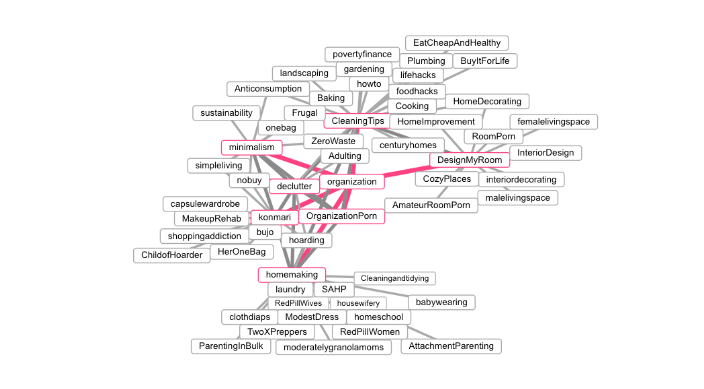

- Reddit is a news aggregator and web forum. It has “subreddits” that are niche-specific communities focused on a particular subject. They are an amazing source of niche communities.

- Go to Reddit and search for your topic. Find a subreddit dedicated to that topic or a similar one. Then, use this tool to search that subreddit. It will give you a visual representation of the subreddits that the users of the group you searched are also commenting on. For example, if you search “organization,” you’ll get a graph of all related subreddits.

You can then click on any one of those subreddits and see the hottest topics and most relevant comments. It’s an efficient way to find all of the places on Reddit where your potential customers are having conversations about their problems.

-

YouTube Comments, Instagram Comments

- Much like Amazon reviews, the comment sections on popular social media channels function like niche communities.

- Search for videos or posts on your topic and scan the comment section. Be mindful of what resonates and look for their pain points and feature requests.

-

Wikipedia

- Look up your topic, skip the content written on the topic, and go to the footer where the citations are. This is where an entire community of people have aggregated the resources that were used to write on the topic. This is a quick way to dive deep into the topic.

But what do we do with all of this?

As you’re going through and doing your research, use a spreadsheet like Excel or Google Sheets to capture what you’re finding. Copy and paste all of the relevant questions and comments related to your product or business into the spreadsheet.

TIP: Capture word-for-word quotes. Do not manipulate the quotes. Instead, capture their exact words. This will be helpful later.

You should capture a minimum of 50 quotes. Ideally, you’ll capture 50-100 but make sure you get at least 50. You’ll need a critical mass of data to be able to generate useful insights. Without it, you may still be searching through too much noise. From there, use a keyword analyzer or AI tool like ChatGPT to see if any words or topics jump out more than others. Drop the quotes you pulled into one and see what stands out. You’ll also want to scan through them yourself and see if you find any common themes. We can’t stress this enough…do the work and read over everything yourself. It will prime your mind to find patterns and validate what the keyword and AI tools summarize for you.

As you’re going through what you’ve captured, here are some criteria for selecting what to value. You’ll want to capture things that are:

- Relevant: Related to the research inquiry and focused. This is not merely the presence of keywords but results from deeper examination and comparison.

- Recent: Timely posts with regularity in the flow of information.

- Relational: People responding and giving feedback to each other, not just a thought leader shouting information from a megaphone.

- Rich: Information that reveals human cultural realities.

Now that you’ve got an understanding of the market through qualitative research, you’ll want to verify and quantify your learnings with quantitative data. Through this contextual research, you’ll learn what you want to confirm quantitatively.

With that in mind, let’s move on to Step 2.

Step 2: Estimate Your Total Addressable Market Size

There are three terms you need to understand when estimating your addressable market size.

They are:

- Total Addressable Market (TAM)

- Serviceable Addressable Market (SAM)

- Serviceable Obtainable Market (SOM)

One of the biggest mistakes we see in newer entrepreneurs is that they get really excited about the size of the market. They might find out the active footwear market is $133B, and then they shut their brains off. They assume that’s the size of the opportunity.

But it’s not.

The $133B is the Total Addressable Market (TAM), the maximum size of the market or opportunity for a given product, but not even Nike captures the whole market. They’ve got this pesky thing called competitors and those competitors - Adidas, Reebok, New Balance - all take a portion of that market.

Then there’s the Serviceable Addressable Market (SAM). Sticking with the active footwear example, the SAM is those subcategories of active footwear like running shoes, gym shoes, tennis shoes, and on and on. The SAM is the niche within the larger market that you’re trying to service.

Then there’s the Serviceable Obtainable Market (SOM). This is arguably the most important number for those of us reading this. It is the realistic portion of the market that you, as an individual business or entrepreneur, can potentially capture.

Start by finding the Total Addressable Market.

Here are three ways you can find your Total Addressable Market.

Three Ways to Find Your Total Addressable Market

- Google it. Again, the easiest thing to do is just Google it. Type in “how big is the [your product or service] market?” For example, if we type in, “how big is the active footwear market?” here are the results we get:

This data is usually very easy to get for bigger industries. - Search a competitor’s site for market size. Use the search tip from step one and search competitor’s sites for the data. Take a competitor’s website and search “site: competitor.com “total market size” filetype: pdf” or “site: competitor.com “total addressable market” filetype: pdf. You may pull up their SEC Filings and they’ll report on that for you.

- Buy data packages. If none of that works, you can also go to websites like MarketResearch.com and buy data packages. These range in price from $3-10k but yield great data and save you time if you have the resources to do so.

Now estimate the total market size that could theoretically buy your product.

Step 3: Estimate Your Serviceable Obtainable Market (SOM)

The temptation as entrepreneurs is to go broad. We want to get as much of the serviceable obtainable market as possible, so we reluctantly narrow our features, offer, or niche to the obtainable market size. Unfortunately, if you go broad, you’re setting yourself up to compete against larger companies with bigger teams and bigger budgets. Instead, go narrow and targeted; find the areas they’re not filling and serve them.

You also need to be mindful of not going too small. You have to hit the market size sweet spot. You want to make sure there’s enough of a market there to build a profitable, sustainable business. This is what we’re going to do now.

Two Quick and Easy Methods to Estimate Your SOM

Here are two methods to estimate your SOM:

- Top Down

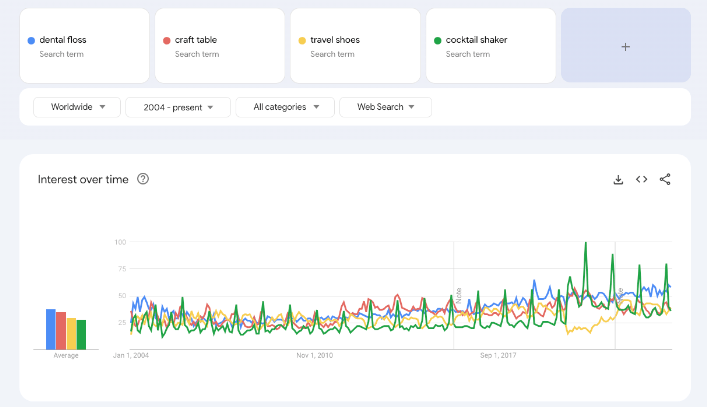

- Pull broad industry data. To do this, use Google Trends. This will show you what people have been searching for over a period of time. The first step is to go to trends.Google.com. We will use this to benchmark against other search terms that will help us understand the volume of demand for our product.

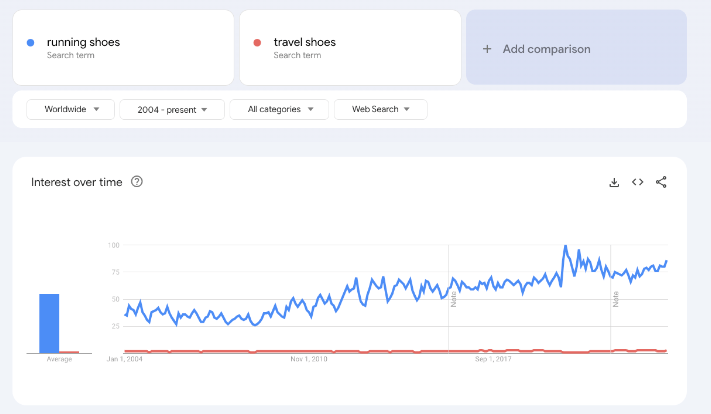

- Benchmark your data against industry trends. We will benchmark against other search terms that will help us understand the volume of demand for our product. To do that, enter the following search terms: dental floss, craft table, travel shoes, and cocktail shaker. Then, change the location to “Worldwide” and the time frame to “2004-Present.” It should look something like this:

- Once you’ve done that, enter your product by clicking the plus sign. For most small businesses, you will want your product to fall somewhere in between those benchmarks. If it’s too high on this chart and is far above the others, it’s probably too competitive. If it’s too low, it probably won’t be profitable enough for you. Remember, these terms are just a starting point that works for most businesses. You can go after bigger markets based on your company’s resources.

- Supply Side (aka Competitors)

- Run a report using your favorite Amazon analytics tool like Jungle Scout or Helium 10 on your specific niche (Ex: Travel Shoes).

- Find 30 day Amazon revenue. Look at total 30-day revenue for the top 100 sellers on Amazon.

- Multiply that by 12 to estimate the annual revenue for the category on Amazon. Multiply 30-day Amazon revenue by 12 (the number of months in the year) to get the total annual revenue from Amazon sales. Google trends should make it clear if there is seasonality in this niche. If so, adjust accordingly. You should also consider potential outliers in the product category that would skew data.

Using “travel shoes” as an example, Crocs took up such a huge chunk of the total and was outside of what we considered a true competitor that we removed their sales from our calculations. - Divide by Amazon sales to account for the percentage of online commerce. According to pymnts.com, Amazon had a 57 percent market share of all e-commerce sales in 2021. Amazon is about 57% of total online sales. To get a rough estimate of online sales, divide the Amazon revenue by 57%.

- ***IF*** you want to take that further, you can divide that number by 15.6% (Estimated percentage of total online sales versus brick and mortar sales) to get a ballpark of the true total $$ of the market. However, this is very subjective to the type of product it is. If it is a small consumer product, I would leave this multiplier out and use total online sales as a proxy for the total market size.

- Run a report using your favorite Amazon analytics tool like Jungle Scout or Helium 10 on your specific niche (Ex: Travel Shoes).

Please keep in mind that these are imprecise methods for calculating your SOM. These are designed for busy entrepreneurs to quickly estimate their SOM without having to invest time or money to get an idea of the size of their potential market.

Now that we’ve researched to understand the marketplace and customer needs, researched the total addressable market, and the size of our opportunity, how do we know when to stop vetting? How much is enough?

Great question…we’ll discuss that in our next, and final, step.

Step 4: When To Stop Vetting and Move On

Let's put it bluntly: you will never know for sure whether or not something will work. You will never have 100% validation. All we’re doing is building evidence.

Tony Fadell, former senior VP of the iPod division at Apple and founder and former CEO of Nest Labs (maker of Google Nest), says there are two types of decisions:

- Opinion-driven decisions

- Data-driven decisions

He says that you will have to rely on opinion-driven decisions for brand-new products. According to him, you will not have the “perfect data” you need to make completely data-driven decisions until your second or third iteration of a product.

No matter how much data you get, it will always be inconclusive. The desire to turn an opinion-driven decision into a data-driven decision will lead to analysis by paralysis. At some point, you will need to rely on the insights you’ve gathered to shape your opinion and make a decision. The purpose of the exercise is to get really good data that builds evidence, gives insights, and helps us make the best decision we can make. It should inform our opinions so we’re not making guesses about what’s possible.

There are always multiple companies executing the same idea at the same time. The ones who make it are the ones who look at business as an ongoing experiment. Everyone reading this has an idea; think of that idea as an experiment.

Can your idea survive this initial market research phase? If not, great! You’ve just saved yourself years of time and maybe tens or hundreds of thousands of dollars. If it does, take it to the next step which is creating product strategy and building prototypes.

Conclusion

Market research is one of the critical steps in developing a successful product strategy. We can use market research to understand competitors, identify trends for product discovery, estimate market size, and make sure it meets our goals to deeply understand our customers. This is useful in crafting marketing messages and key product features, and ultimately developing products that suit our customer’s needs. We want to make sure we’ve got a problem worth solving and a solution worth building.

Market research is the process of moving from what we think we know to what we know we know. The next major challenge people run into is narrowing down critical features and actually developing a product.

Master Market Research and New Product Development with Expert Guidance

Developing a new product is daunting. It’s a lengthy process that can be intimidating and expensive. That's exactly why Product EVO is here. Our experienced product development firm can guide you through the process.

We can help you:

- Conduct effective market research that saves time and money.

- Create a product strategy that addresses your customer’s needs and avoids bloated features.

- Get quotes that reflect the true costs of product development.

- Source overseas manufacturers for developing your product.

Choosing the right overseas partner is an important step in your journey. Book a call with us today to learn how to turn your product vision into reality!

Book a Call